Welcome to our two-part series examining GASB 103 and its impact on local governments. In this first article, we’ll review GASB 103, and then examine its role in budgetary comparison. In the second article, we will continue to dig into GASB 103 with a focus on proprietary funds.

Welcome to our two-part series examining GASB 103 and its impact on local governments. In this first article, we’ll review GASB 103, and then examine its role in budgetary comparison. In the second article, we will continue to dig into GASB 103 with a focus on proprietary funds.

GASB 103 Overview

Governmental Accounting Standards Board Statement No. 103 (GASB 103) focuses on improving the financial reporting model. Issued in April 2024, it aims to enhance the effectiveness of financial reporting by refining key components that help with decision-making and accountability.

This update includes several major points:

- Management’s Discussion and Analysis (MD&A): Requires a structured approach to presenting financial activities, ensuring clarity and avoiding unnecessary repetition.

- Unusual or Infrequent Items: Mandates separate display of inflows and outflows related to such items in financial statements.

- Budgetary Comparisons: Several changes seek to make budgetary comparisons more informative and accessible and align them with overall financial reporting improvements.

- Proprietary Fund Statement Presentation: Continues the distinction between operating and nonoperating revenues and expenses.

These new requirements take effect for fiscal years beginning after June 15, 2025.

The good news is that the updated guidelines do not significantly change the accounting basis or presentation of financial information for government entities. For the past decade, GASB has examined “GASB Statement No. 34 Basic Financial Statements – and Management’s Discussion and Analysis – For State and Local Governments” to determine its effectiveness. Overall, it appears to be working well, so major changes were not made to GASB 34. Instead, the organization issued GASB 103 to introduce targeted improvements to financial reporting, including changes to budgetary comparison information.

GASB 103 Impacts on Local Governments

There are several areas where GASB 103 will impact local governments. Overall, the guidelines seek to implement targeted improvements to financial reporting. The goal is to enhance transparency and decision-making.

Management Discussion and Analysis (MD&A)

Perhaps one of the biggest impacts on local governments will be in the Management Discussion and Analysis (MD&A) portion of financial disclosures.

The Structure of the MD&A

The MD&A follows a defined format. It includes five sections:

1. Overview of the Financial Statements

2. Financial Summary

3. Detailed Analyses

4. Significant Capital Asset and Long-Term Financing Activity

5. Currently Known Facts, Decisions, or Conditions

Revised MD&A Guidelines

GASB updates and re-establishes the guidelines for the MD&A section. Governments are required to report and explain what changed during the reporting period and why the changes occurred. More detailed descriptions, including details about the items discussed and known facts, conditions, and decisions, must be included. Anything that has a significant financial impact on the reporting period should now be included in the narrative.

Another change is the overall approach to reporting. GASB encourages entities to focus on reporting for laypeople to make the information easily understandable by the average citizen. This includes people who may not be from the geographic area, or people who do not have a detailed understanding of government finances and accounting.

The important takeaway is that local governments should include information on why numbers changed, not just the facts about what changes. In other words, GASB is encouraging transparency around the numbers so that citizens can understand not just the actual numbers but also the reasons behind any changes governments report in their MD&A.

Budgetary Comparisons Information

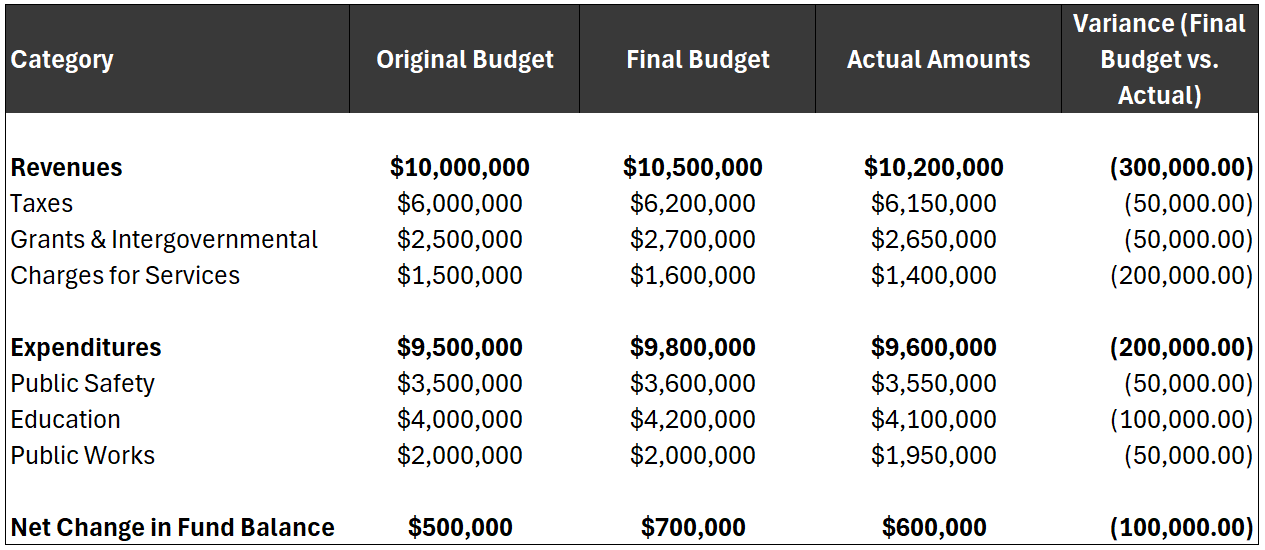

This section of the financial report discusses how local governments should present budgetary comparisons. Like other sections of GASB 103 addressing reporting, the emphasis is on sharing information in an accessible, understandable manner. The goal is to make sure that citizens reviewing the budgetary comparison understand what they are reading and that it is not cloaked in jargon or obscured in any way.

Budgetary Comparison Schedules Mandatory for General Fund And More

GASB 103 now makes budgetary comparison schedules mandatory for the general fund and major special revenue funds with legally adopted budgets. They must be presented as Required Supplementary Information (RSI) instead of part of the basic financial statements. What this means is that budget analysis should no longer be included in the MD & A.

New Methods of Display Required

Another requirement for the budgetary comparison schedule is that it must include columns showing variances between the original and final budget amounts, as well as the final budget and actual results. Explanations of significant variances must also be provided in the notes to the RSI.

Key Takeaways

The key takeaway for GASB 103 is clarity, focus, and transparency. These are the watchwords that seem to have guided the changes to reporting.

Summary of GASB 103 Changes

1. Management’s Discussion and Analysis (MD&A) Refinements

- Requires a more structured approach with five defined sections.

- Focuses on explaining why financial changes occurred, not just what changed.

- Discourages unnecessary repetition and generic discussions.

2. Unusual or Infrequent Items

- Transactions that are either unusual or infrequent must be separately displayed.

- Eliminates the previous distinction between extraordinary and special items.

3. Budgetary Comparison Information

- Budgetary comparison schedules are now mandatory for general funds and major special revenue funds.

- Must be presented as Required Supplementary Information (RSI) instead of in basic financial statements.

- Requires columns showing variances between original and final budget amounts, plus explanations for significant variances.

4. Proprietary Fund Statement Presentation

- Continues the distinction between operating and nonoperating revenues and expenses.

- Defines nonoperating revenues and expenses more clearly, including subsidies received or provided.

5. Improved Financial Transparency

- Encourages governments to present financial information in a way that is understandable to the average citizen.

- Requires explanations of known facts, decisions, or conditions expected to impact future financial periods.

It seems as if in every aspect of government, there is a push for more accountable, transparent, and trustworthy. Financial statements are an integral part of building and maintaining trust. Local governments can use the changes required in GASB 103 to build a strong bridge of trust with the community by ensuring that in everything they do, they are being good stewards of government finances.

AccuFund Government Accounting Software

AccuFund offers government accounting software that supports easy, transparent reporting of financial activities. Whether you are looking for government solutions that include enterprise resource planning (ERP) systems, human management software, representative payee, or government accounting software that integrates with other systems like utilities billing and taxation, AccuFund’s specialized approach to government accounting software ensures that local governments have a reliable, affordable, and modern accounting solution.

Related Materials

AccuFund Government Accounting Product Webinar

White Paper: Critical Considerations for Purchasing a Government Accounting System