The deadlines for ASU 2016-14 are approaching. Implementation of the standards will be disruptive – whether that disruption is minimal or acute will depend on how prepared you are and the capability of your nonprofit accounting solutions.

The deadlines for ASU 2016-14 are approaching. Implementation of the standards will be disruptive – whether that disruption is minimal or acute will depend on how prepared you are and the capability of your nonprofit accounting solutions.

FASB ASU 2016-14: Here’s what’s changing for nonprofit organizations

Very simply put, the face or the presentation of your financials will be simplified. Temporary and permanent restrictions will be combined into one column rather than being represented in two columns. Enhanced disclosures should be relegated to the notes section of your financial statements.

For a more comprehensive treatment of the FASB ASU 2016-14 reporting requirements, download Part 1 in the 3-Part White Paper Series, 'Understanding. Preparing. Implementing. FASB ASU 2016-14 Reporting Requirements for Not-For-Profit Organizations'.

Be Prepared: Calculate the applicable deadline and chart your course

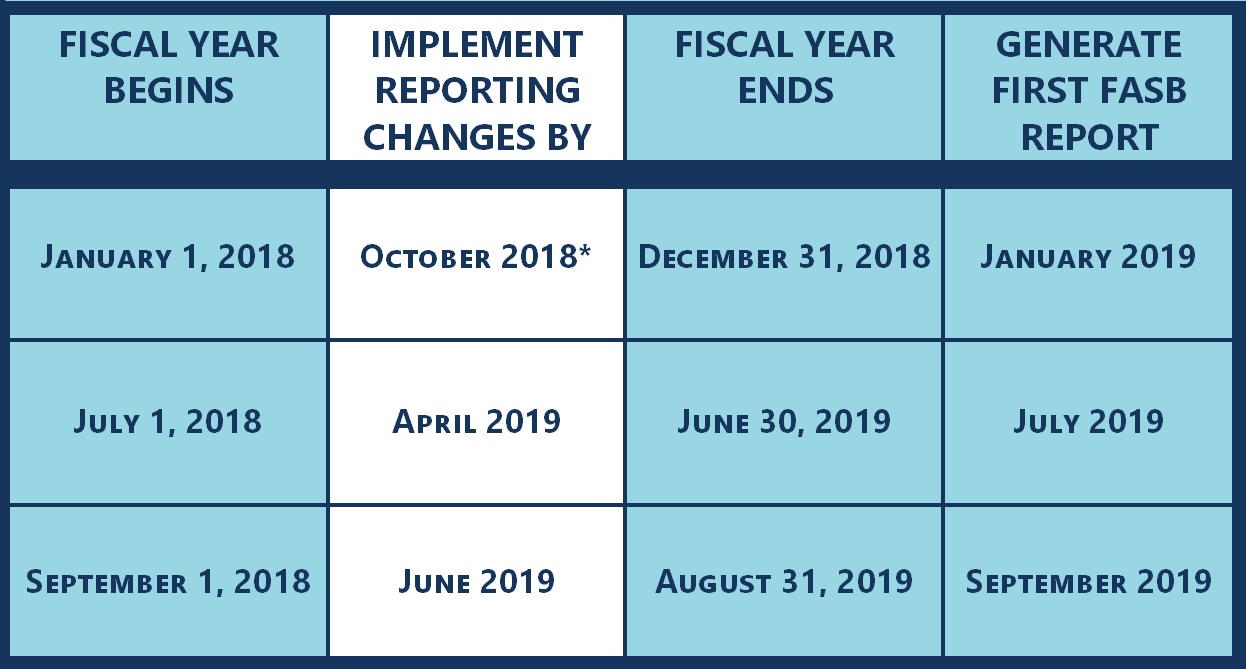

The new FASB ASU 2016-14 standards apply to annual financial statements issued for fiscal years beginning after December 15, 2017. So, if your fiscal year began on January 1, 2018, you will need to generate reports reflecting the new standards starting January 2019.

Here is a chart that is designed to help you map out your timeline to compliance:

*May require retrospective accounting entries if not implemented prior to January 2018.

The completed transition to new reporting requirements will depend on your fiscal year. Working backwards from the deadline for your organization, determine what changes you will need to make and create a plan for implementation.

We suggest having changes to your reporting in place three months before the actual deadline. This will give you time to review your reporting and make any adjustments. Having a trial period of adjustment prior to the actual deadline will be far less stressful for you and your team.

The chart above comes from Part 1 ‘Understanding. Preparing. Implementing. FASB ASU 2016-14 Reporting Requirements for Not-For-Profit Organizations’ which you may download, by clicking on the link.

FASB ASU 2016-14 Main Provisions: What do these changes impact

The 5 key areas FASB ASU 2016-14 has been designed to address are:

1. Net asset classification complexity

2. Liquidity of funds transparency

3. Deficiencies in reporting financial performance measures

4. Expense reporting inconsistencies

5. Misinterpretations of cash flow information

Is your nonprofit accounting solution able to generate reports compliant with the new standards? If not, it might be time to put a plan in place for upgrading your nonprofit accounting solution.

As you prepare for the biggest nonprofit accounting standards change since FASB 116 and 117, know that AccuFund is here to help. We have been exclusively committed to the Nonprofit and Government sector since our founding. Your accounting challenges and finding a solution to them is our single focus.

The good news for AccuFund users is that the software is already able to produce ASU 2016-14-compliant reporting formats. AccuFund can demonstrate compliant financial statement presentation in all key reports: Statement of Activities; Statement of Financial Position; Functional Expense Report; and Statement of Cash Flows.

Get started by downloading Part 1of ‘Understanding. Preparing. Implementing. FASB ASU 2016-14 Reporting Requirements for Not-For-Profit Organizations’. Remember this is Part 1 of a 3-Part Series.

Part 2 of AccuFund's 'Understanding. Preparing. Implementing. FASB ASU 2016-14 Reporting Requirements for Not-For-Profit Organizations' white paper series continues with how to address the process, tasks, and decisions associated with preparing to implement all the FASB ASU 2016-14 reporting changes and is also available for download.

Part 3 of 'Understanding. Preparing. Implementing. FASB ASU 2016-14 Reporting Requirements for Not-For-Profit Organizations' is an active project plan to help you and your organization focus on task-oriented items detailed in all 3 phases; understanding, preparing and implementing.

For additional FASB ASU 2016-14 resources, visit AccuFund's compilation of FASB ASU 2016-14 Reporting Requirement Resources.

Want to talk to an AccuFund expert pronto? We get it. Having the right software will make this change much easier than trying to find a work-around in an inadequate system. Contact us and we’ll talk about the specific needs of your organization.

AccuFund, Inc. is 100% focused on serving nonprofits and government entities. The complete fund accounting financial management solution, available online or onsite, consists of a strong core system and modules that allow you to expand as your needs evolve.