Lebanon, Kentucky

Success Story

City in Bluegrass Country Was Singing the Blues Over Its Legacy Accounting System

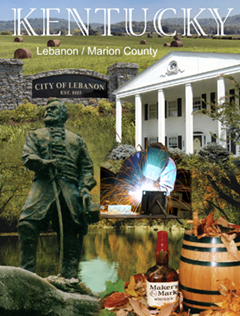

The City of Lebanon is located in Kentucky bluegrass country in the geographic center of the state. It serves as the county seat for Marion County, which is the heart of the state’s world-famous production of Kentucky straight bourbon whiskey and home to the Maker’s Mark distillery started in 1815.

First settled in 1789, the City of Lebanon has established itself in recent years as a center of commerce and industry. With a 2004 population of 5,884, Lebanon contains almost one-third of Marion County’s total population.

End of Support Meant New Life for the Lebanon Admin Department

Lebanon’s fiscal matters are overseen by the administrative department, which includes the city administrator, the city clerk and two assistant city clerks, one of whom serves as the tax administrator. This department is responsible for collecting local fees and taxes such as restaurant, hotel and liquor taxes, issuing and collecting fees for licenses such as business licenses, managing the payroll for city employees, and establishing the city’s annual budget and expenditures.

To manage all of its accounting tasks, the Lebanon administrative department was using an accounting software system that had been on the market for many years, and was a DOS-based system. The software offered little flexibility and limited control to posting items to the general ledger in a timely manner.

“We needed a better handle on getting the general ledger posted,” states Lebanon City Administrator, John Thomas.

When the manufacturer of the accounting system announced it was discontinuing support, Thomas and the city of Lebanon administrative department knew the time had finally come to seek out a replacement.

AccuFund Outshines the Competition in Thorough Review

The City of Lebanon did a thorough search for the accounting software that would best meet its needs, ultimately selecting the AccuFund Accounting Suite.

“We researched five or six accounting packages before making our decision,” states Thomas. “We chose AccuFund because it had all the features we were looking for, and we could see during the demo that there was simplicity with each module.”

Lebanon purchased the AccuFund Accounting Suite’s core system as well as the Payroll, Accounts Receivable, and Fees, Taxes & Licenses modules.

“Because each module is straight-forward and similar, cross-training our employees was easy,” states Thomas. “Employees who are trained and working on one module can easily use another module, if necessary. For example, if the person who typically uses a particular module is out sick, someone else in our office can help the customers.”

Among the Lebanon city administrative department’s staff, the assistant city clerks use the AccuFund Accounting Suite the most. One oversees Accounts Payable and Payroll, while the other serves as tax administrator and manages the tax receivables and the Fees, Taxes & Licenses modules.

The department’s secretary/receptionist oversees Accounts Receivable. The AccuFund Accounts Receivable module’s import capabilities make it possible to receive an electronic file from the county each time property taxes are billed by the county.

Thomas, as city administrator, determines the budget and expenditures, runs reports and reviews receipts. The biggest task for the department each month is payroll. Payroll is distributed bi-weekly plus some employees are paid the first of the month, therefore there are three payrolls per month.

“We researched five or six accounting packages before making our decision,” states Thomas. “We chose AccuFund because it had all the features we were looking for, and we could see during the demo that there was simplicity with each module.”

Lebanon’s Administrative Team Couldn’t Be Happier with AccuFund

Thomas reports that since going live with the AccuFund Accounting Suite in August 2007, the Lebanon city administrative department has been “very satisfied.”

“AccuFund saves about 15-20% of our time, freeing us to attend to other things,” Thomas elaborates. “It is easier on the staff to no longer have the redundancy of the previous system.”

Pate Williams from Waypoints, LLC, the reseller who worked with Thomas and the City of Lebanon to install AccuFund, points out, “With AccuFund, it was the first time they could have a customer come in to pay a tax and then bring up their account status on the computer screen. They are now able to stay up-to-date on all their accounting and records, and they can now be more proactive than reactive.”

“When we were shopping for the product, the big benefit we sought was the ledger entry,” states Thomas. “With AccuFund, the general ledger can be posted as you go, regardless of the number of entries being made each day. Everything is posted immediately. If you check the ledger and find an incorrect entry, you can go back and correct it in the journal entry. AccuFund automatically creates a due to/due from record to let you know where funds were credited and debited.”

Another feature of the AccuFund Accounting Suite that stands out for Thomas is its adaptability. “We can change the product to suit our needs, not make changes in how we do things to fit with the product,” he explains. “For example, we can have a boilerplate report created that is customized to our needs. If we like, customizations to reports as well as updates to the software can be made online.”

With respect to product support from Waypoints and AccuFund, Thomas has been very impressed. “We have not had anything come up that could not be resolved and that’s worth a lot,” he states.

Overall, the city of Lebanon has gained a tremendous advantage in terms of time savings, ease of use, increased control and flexibility. Thomas concurs by saying, “Waypoints and AccuFund have delivered a fine product. Even though the cost of AccuFund is just slightly higher than our previous system, the overall benefits of the system completely offset it.”

“AccuFund saves about 15-20% of our time, freeing us to attend to other things,” Thomas elaborates. “It is easier on the staff to no longer have the redundancy of the previous system.”

Let's Get Started

AccuFund supports your mission with a full suite of financial management applications for nonprofit and government organizations. To learn more and arrange a demo, contact AccuFund at 877-872-2228 or