Cash Receipts

AccuFund Onsite

Easily Streamline Recording of Receipts

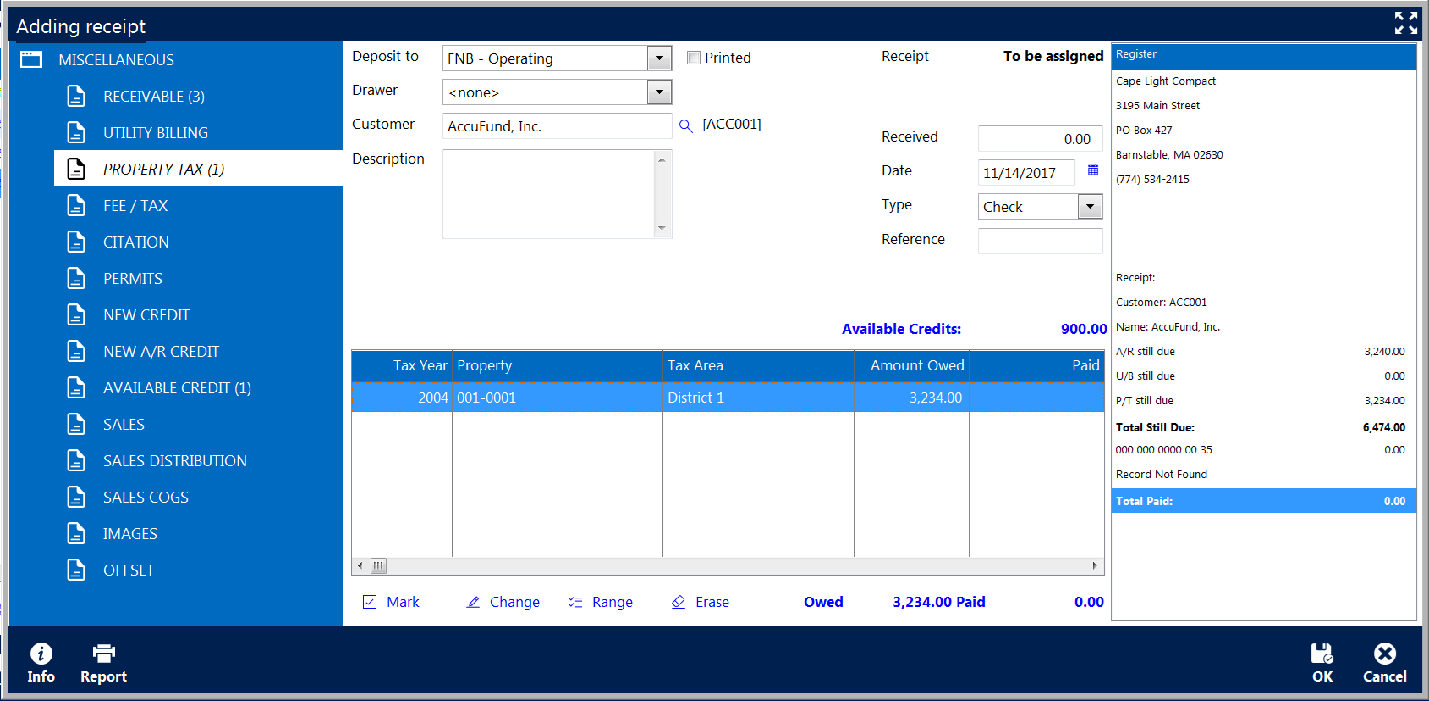

Cash Receipts makes it easy for nonprofits and governments to manage inflows from all sources. As a part of our Core system, the Cash Receipts component is the center point for receipts from all modules within the AccuFund Accounting Suite.

For nonprofits, this includes Accounts Receivable and Client Invoicing.

For governments, it integrates with Utility Billing, Property Tax, Court Fines, Permits and Inspections, and Fees, Taxes and Licenses.

From Cash Receipts you can:

- Handle all your cash, check, and credit card receipts, including convenience fees.

- View any customer’s outstanding items.

- Apply receipts unrelated to specific billing or receivable to a General Ledger account.

Cash Receipts includes convenient customer receipt forms, deposit slips, deposit tickets, and deposit logs, as well as reporting on receipt distribution, customer credit, credit aging, and credit distribution.

Cash Receipts Online Version

Improve Your Workflow

Cash Receipts can be used effectively by people who receive payments through the mail (back office users) or behind a counter (front office users).

As soon as a payment by cash, check, or credit card is received, the amount can be entered and applied to various receivables.

To ensure accuracy, Cash Receipts offers a double-check feature that applies receipts to outstanding invoices. Invoices are listed on the receipt screen, so users can see which specific invoices will be credited.

If a customer prepays, overpays, or double pays an invoice, users can set up an accounts receivable credit on the cash receipt and distinguish it from other cash credits.

When creating a receipt for miscellaneous cash, Cash Receipts lets users identify the receiving bank and account. In the receipt’s description field, users can indicate what the cash is for and who paid it.

Key Features for Nonprofits and Governments

AccuFund Cash Receipts offers valuable functions that increase efficiency:

- A Sales Screen provides a simple interface for low-volume items, such as decals, books, and passes.

- Cash Receipts posts to an undeposited funds account in the General Ledger, instead of a cash account, until a deposit is created.

- When applying cash to receivables, all affected modules in the AccuFund Accounting Suite show the number of items related to the customer.

- If funds are received and it’s not clear how to apply them, users can apply a cash credit or an accounts receivable credit.

- Credits can be refunded to customers through the Accounts Payable module.

- Open credits, as well as cash, can be applied at the same time.

- Excel or CSV files are easily imported using the Import Wizard.

Extra Features for Government Organizations

AccuFund’s government license includes additional Cash Receipts features for specific municipal use cases:

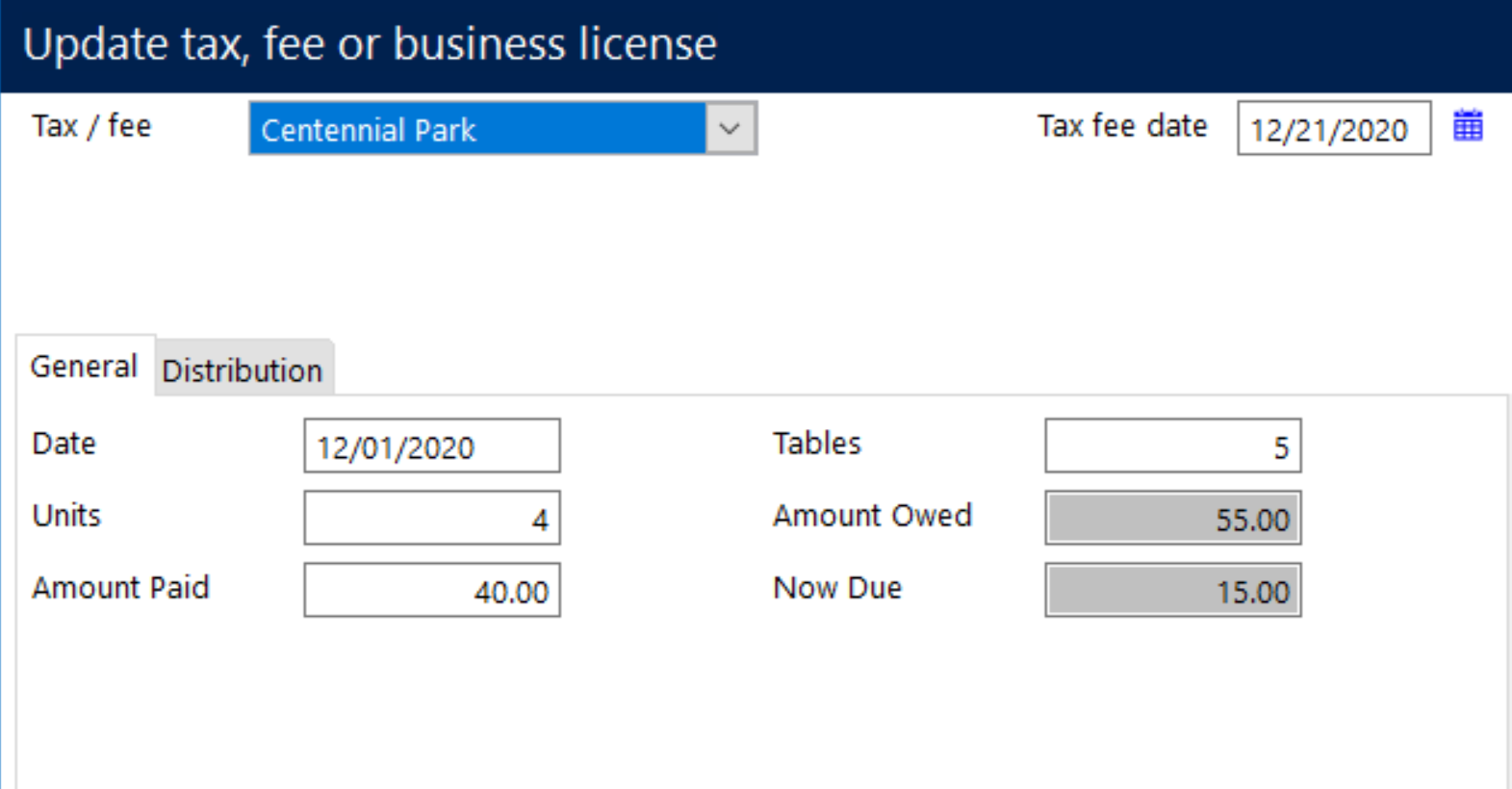

- The Utility Billing module manages invoices for public utility service. Municipalities use cash credits for recording deposits.

- The Building Permits module ensures that construction project plans comply with zoning and land use regulations. Cash Receipts is used to collect, track, and process Building Permit fees.

- The Property Tax Billing module manages tax assessments for different types of property: real (land, buildings), as well as personal (automobiles, motorcycles, trailers).

- The Fees, Taxes & Licenses (FTL) module is used for issuing decals and permits, as well as recording sales tax.

- The Court Fines/Citations module tracks citations issued by law enforcement. Cash receipts created for citations paid include a citation field.

Let's Get Started

AccuFund supports your mission with a full suite of financial management applications for nonprofit and government organizations. To learn more and arrange a demo, contact AccuFund at 877-872-2228 or