Property Tax

AccuFund Onsite

Take the Pain Out of Property Tax Billing

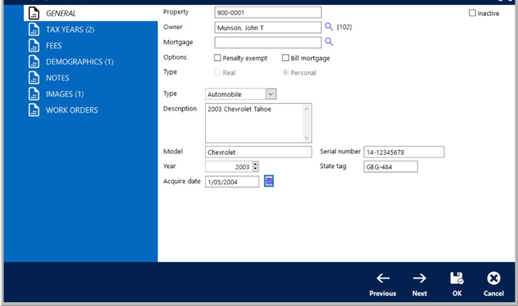

AccuFund’s Property Tax module gives local government entities—such as municipalities and school districts—a smarter way to manage tax assessments for a range of property types, including real estate (land, buildings) and personal property (automobiles, motorcycles, trailers).

Property Tax module allows you to download customer and property data from county, state, or assessors’ records. Property tax payments are posted directly to customers and can be integrated with Utility Billing. Because tax payment activity is linked to customer information in the database, you can ensure your records are correct. These efficiencies cut your total data entry time in half, so you can get tax bills out the door quickly.

Simplify Complex Processes

The Property Tax module open format allows you to easily convert from another system, make alpha-numeric inputs, and add data fields on the fly.

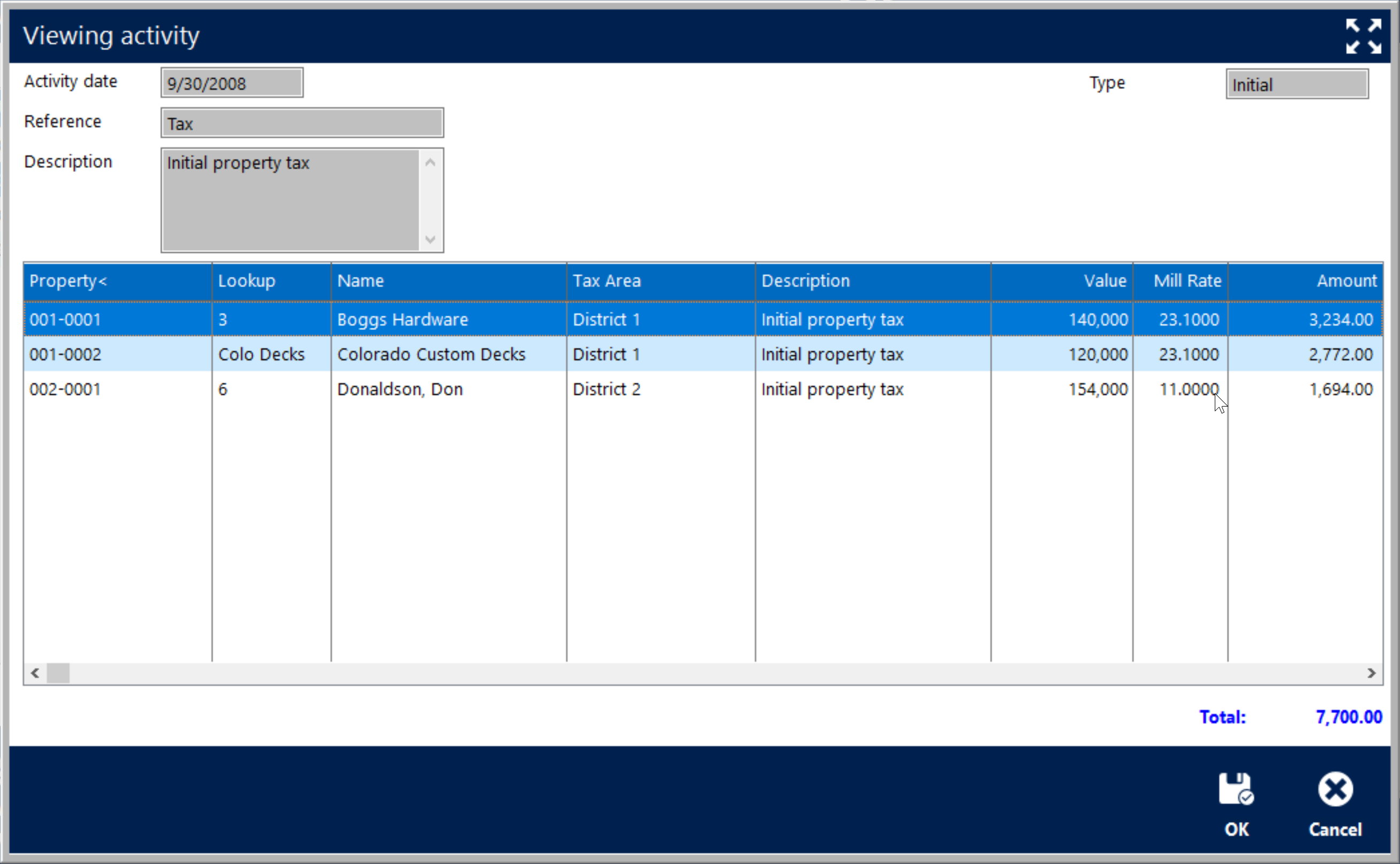

Now you can perform multiple assessments according to various tax values and tax years. And, without any additional programming, you can perform surcharges, penalties, and other calculations that are unique to your entity.

You can also maintain a complete online history of tax activity and link it to your customer database in the AccuFund Accounting Suite. That means you can perform all interest or penalties calculations on past-year activity, as well as on the current year.

Property Tax Online Version

Enjoy User-Friendly Features

The AccuFund Property Tax module includes features designed with the tax clerk’s job in mind:

- Run preliminary reports to identify needed changes.

- Create receipts for tax payments in the Cash Receipts module.

- Apply additional charges, such as late fees and interest.

- Click on a column header and enter ctrl+L to search for specific information and bring up activity detail.

- Select on screen options for specific circumstances, such as “Penalty Exempt” and “Bill Mortgagee.”

- Make and apply manual adjustments automatically.

- Provide supplementary tax services, such as vehicle decals/stickers.

Create Custom Reports with the Touch of a Button

Property Tax can produce a report on any transaction or activity. The default reports include:

- Personal Property Statement

- Real Property Statement

- Property List

- Property Assessments

- Personal Property Fees

In addition, the Property Tax module lets you customize reports and forms through a variety of easy-to-use tools:

- Reports—Run any defined report for properties, tax activities, and customers.

- Quick Reports—This feature converts what’s on the screen to a report or export, sorted by any column.

- Report/Forms Designer—This tool enables you to create customized statements, full-size 8 ½ x 11 letters, mailers, and other reports. Users can generate an entire tax run or reprint any individual statement in a tax run.

- Notes—Input additional information on any property. Notes can be categorized and can include downloaded images.

Multiply Efficiencies with Built-in Integrations

You’ll save time and reduce errors when you link Property Tax with other key AccuFund modules:

- General Ledger for financial reporting

- Cash Receipts for cash history

- Fees, Taxes & Licenses for issuing decals

Let's Get Started

AccuFund supports your mission with a full suite of financial management applications for nonprofit and government organizations. To learn more and arrange a demo, contact AccuFund at 877-872-2228 or